Yalla Group Q3 Earnings: Quarterly revenue passes US$ 80 million as steady growth continues

|

|

Revenue hits a quarterly high

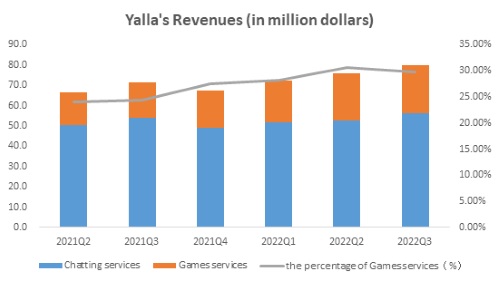

Yalla’s revenues were US$ 80.1 million in Q3 2022, representing a YoY increase of 12.3% and a QoQ increase of 5.2%. The figure surpasses the revenue guidance for the quarter (US$ 75 million) and represents a new record for the social media outfit.

In terms of business segments, revenues generated from chatting services reached US$ 56.2 million, representing a YoY increase of 4.3% and a QoQ increase of 6.7%. Revenues generated from gaming services were US$ 23.9 million, representing a YoY increase of 36.9% and a QoQ increase of 2.3%. After the high-speed growth during the pandemic, Yalla’s growth rate has stabilized. Thanks to strong operational management and product innovation, both business segments have achieved steady growth.

In terms of profitability, due to spending on R&D, the promotion of new products, and a renewed focus on customer acquisition, Yalla’s profit margin dropped slightly but generally remained broadly stable. In Q3 2022, the non-GAAP net income was US$ 29.4 million, representing a YoY decrease of 11.5% and a QoQ increase of 2.7%. The non-GAAP net margin was 36.7%, representing a slight decrease of 0.9% compared with Q2.

For Q4 2022, Yalla’s management expects the revenues to come in between US$ 70 million and US$ 76 million. This would represent a considerable YoY growth of between 3%-12%, as revenues in Q4 2021 came in at US$ 67.6 million.

Hardcore games entered the testing stage

In the second half of 2021, Yalla announced the establishment of its subsidiary, Yalla Game. The business segment develops and runs a range of mid-core and hardcore games in the Middle East and North Africa (MENA). Yalla Game has recently created and launched its first hardcore SLG game – Merge Kingdom – and after nearly a year, the application has reached another major milestone.

Merge Kingdom has now been released in its beta version in many MENA countries, Yalla management highlighted in the Q3 report. At present, Yalla Game is actively collecting user feedback and adjusting the product to meet client needs, the firm stated.

Meanwhile, Yalla’s management revealed that the company planned to release its second hardcore game in the MENA region and that more details would be announced by the end of this year.

Positive signs for gaming monetization

In 2021, Yalla launched its casual game portfolio, including Yalla Parchis, 101 Okey Yalla, and Yalla Baloot, in dozens of countries such as Colombia, Turkey, and Mexico. These products are showing considerable promise for monetization though they only generated limited revenues for now.

In Q3 2022, Yalla Parchis ranked in the top five board games in 10 countries including Colombia, Mexico, Chile, and Spain. According to Yalla’s management, the firm undertook activities in Q3 to enhance user acquisition. Taking the Spanish market as an example, Yalla launched an activity “Tomato Battle” with reference to “La Tomatina” – a traditional Spanish festival featuring the red fruit. This game attracted more than 50% of daily active users and increased the consumption of diamonds (top-up virtual currency) on the platform by over 20%.

As for 101 Okey Yalla, Yalla added an independent chat room to the app during the quarter to meet the chatting needs of local users. According to Yalla’s management, the number of paying users and the payment ratio of 101 Okey Yalla improved considerably, while its total revenue increased by over 100% compared with the previous quarter.

It is also worth mentioning that Yalla has made many improvements to its flagship product, Yalla Ludo, to enhance the profitability of its game portfolio. In Q3, Yalla launched distribution gift cards for Yalla Ludo on its marketing channels, which improved the monetization of products. Meanwhile, Yalla added the applet Yalla Ludo to the IM product YallaChat, which gives users full access to the game assets and data in the application.

A platform for future growth

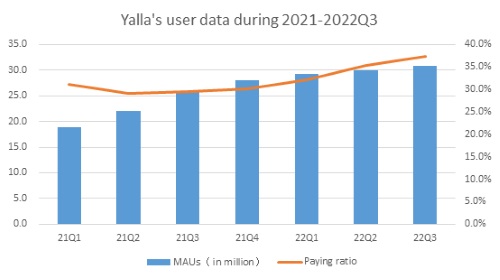

In Q3 2022, the number of monthly active users (MAUs) was 30.9 million, representing a YoY increase of 19.1% and a QoQ increase of 3.3%. Growth in MAUs has been seen for 10 consecutive quarters. This is the first time that the MAUs of Yalla topped 30 million.

With regards to paying users, Yalla has focused on improving the paying user conversion rate since 2022. The ratio of paying to non-paying users has increased from 30% at the end of 2021 to 37.4% in Q3 2022 – this is expected to increase further in the future.

The development of mid-core and hardcore games and the further development of casual games also contributed to Yalla’s rising costs. Yalla’s research and development expenses in Q3 increased by 42.2% compared with the same period last year. In the field of casual games, Yalla increased its sales and marketing expenditure, which contributed to growing operating costs. In Q3, sales expenditure increased by 9% compared with the same period last year. Meanwhile, the cost of revenues increased by 26.3% compared with the same period last year.

It is worth mentioning that Yalla Group has developed a very healthy cash position which will aid future expansion. Despite increasing expenditure, Yalla’s cash and cash equivalents were US$ 391.2 million at the end of Q3 2022 – representing growth against the previous quarter. Yalla’s positive cash flow is one of the reasons why I have been paying close attention to the company as rising interest rates increase the cost of growth for companies in need of borrowing. Yalla can even earn interest on its capital deposits.

Closing Remarks

Looking beyond future growth expectations, the stock looks attractive on value alone. The voice-centric social networking and entertainment platform doesn’t look expensive by several metrics. It has a forward price-to-earnings ratio of 6.01, versus a sector average of 12.8, while its price-to-sales ratio is 2.14, above the industry average of 1.24. And given the size of its net cash position, it has an enterprise value-to-sales ratio of 0.72 versus a sector median of 1.95. Collectively, these metrics look positive.

Considering the above, I’m expecting to see the share price push upward in the coming months towards $6 a share. This would bring the EV / share ratio closer in line with the sector average.

Copyright 2022 ACN Newswire. All rights reserved. (via SEAPRWire)